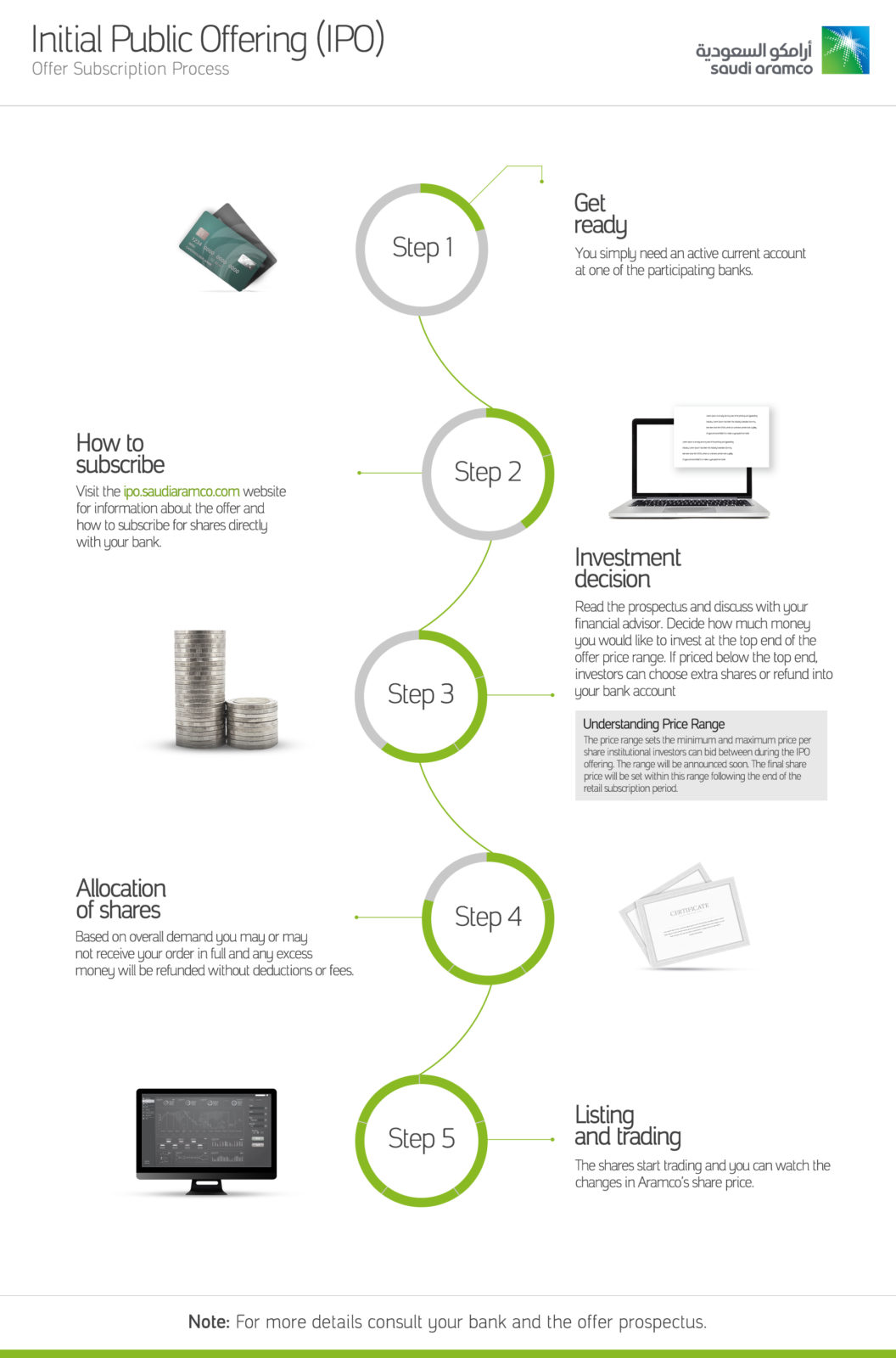

Riyadh — Saudi Aramco said it would start taking bids from investors on Nov. 17 in a highly anticipated stock offering, as it released its prospectus on Sunday.

The 658-page document said the final share price would be determined on Dec. 5, a day after subscriptions close, in what is expected to be the world’s biggest initial public offering.

ADVERTISING

Aramco said it will sell a part of its shares to institutional investors, including foreign companies, as well as to individual Saudis and other Gulf nationals.

The company said it has decided to sell up to 0.5 percent of its shares to individual investors while it will decide on the percentage for larger investors later.

“The targeted percentage of Offer Shares allocable to individual investors will be up to 0.5 percent of the shares,” the prospectus said.

The company said it will determine the percentage to be sold to institutional investors after consultations with its financial advisors and global coordinators consisting of major international banks.

Even though the size of the IPO has not yet been disclosed, it is expected to be the biggest ever, raising over $30 billion.

The prospectus said the offering period will start on Sunday, Nov.17, ending on November 28 for individual investors and on Dec.4 for institutional investors.

The company will set a price range for the shares on November 17 but the final price will only be determined on December 5, the day after all subscriptions close.

“Trading of the shares is expected to commence after all relevant legal requirements and procedures have been completed,” the company said without setting a specific date.

Aramco officials last week announced a share sale on the Riyadh stock market for the world’s most profitable company, which pumps 10 percent of global oil supply.

Saudi investors appear keen on the prospect of owning a piece of the company, seen as the Kingdom’s economic crown jewel.

The company said it had hired a host of international banking giants including Citibank, Credit Suisse and HSBC as financial advisors and book-runners.

Based on a $1.5 trillion valuation, a two percent stake sale would raise Aramco $30 billion. That would still make it the world’s biggest IPO, eclipsing Chinese retail giant Alibaba’s $25 billion listing in 2014.

Saudi Arabia is pulling out all the stops to ensure the success of the IPO, a cornerstone of Crown Prince Muhammad Bin Salman’s ambitious plan to steer the economy away from oil by pumping tens of billions of dollars into a host of megaprojects and non-energy industries.

China, the world’s top oil importer, may commit as much as $10 billion through sovereign wealth funds and other state-owned enterprises, Bloomberg News reported.

Aramco, a company that catapulted the Kingdom to become the Arab world’s biggest economy, does appear to hold enormous appeal for local retail investors.

Many Saudis appear to be tapping lenders and selling personal assets to raise money to invest in the share sale.

Aramco last year posted $111.1 billion in net profit. In the first nine months of this year. — AFP

credit: Saudi gazette